Ride-sharing app Uber, for example, has raised more than $16bn and is valued at more than $69bn.

Then there are the so-called “decacorns” – unicorn startups valued at tens of billions of dollars – such as Airbnb, Uber and Palantir – which some believe are overvalued, but it’s hard to tell until they go public and are forced to reveal details of their underlying finances. “It used to be that 95% of rounds were up, now 20% are down,” Tunguz said.

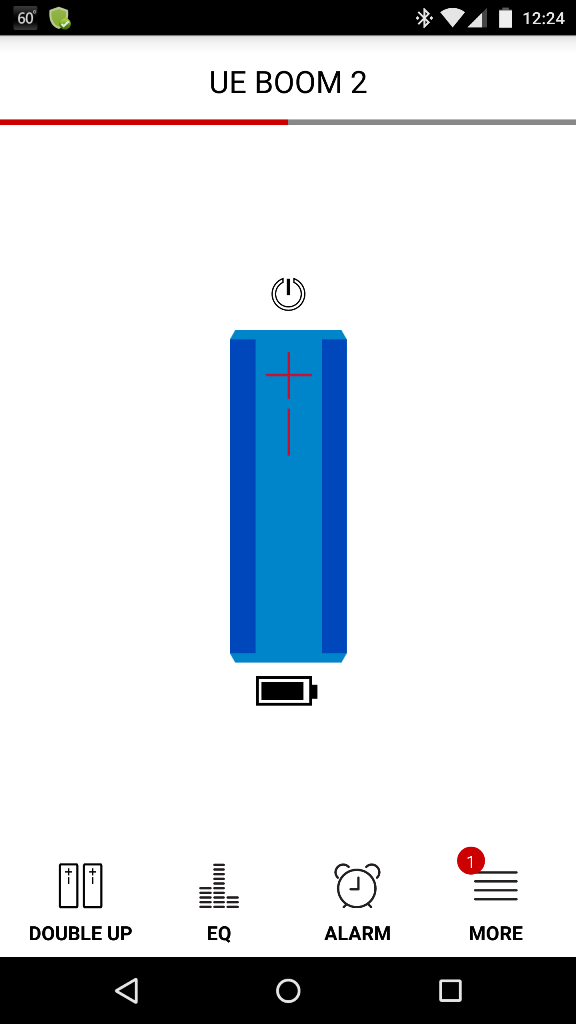

BOOM 2 APP CRASHES 2017 SOFTWARE

CB Insights has tracked more than 100 of these down rounds and exits since 2015, including software company Zenefits, mobile app Foursquare and online music streaming service Rdio. “Silicon Valley has not had a major success in terms of IPO before Snap for years – and Snap is in LA,” Dinan said.Ī stream of “down rounds” – when a company raises funds by selling shares that are valued lower than the last time they raised funds, leading its overall valuation to fall – has led investors to be more discerning. Last year was the slowest for US IPOs since the recession, with the amount raised by technology companies falling 60% from 2015, according to Bloomberg News. This is partly because of a slowdown in companies going public. It’s not as easy to raise capital and VCs are demanding better terms,” added Aswath Damodaran, a professor of finance at the Stern School of Business. “It’s been happening for a couple of years.

“The number of investments has fallen by about a third, but the amount of capital is around the same,” said Tomasz Tunguz, a venture capitalist at Redpoint, adding that some of the “fast money” from hedge funds and mutual funds had shifted away from the sector. These startups are running out of money because VCs are being more discerning about where they place their money, making fewer, bigger bets.

“We’re starting to get a lot of résumés from companies where the business model isn’t working and they can’t get funding, so they are closing down or cutting back,” said Mark Dinan, a software recruiter based in the Bay Area, who keeps track of companies’ hirings and firings.

0 kommentar(er)

0 kommentar(er)